Copart (CPRT)

For this edition of ValueTeddy’s Write-ups we are taking a look at Copart, as suggested to me by the highly inspiring Professor Kalkyl. Copart have had a massive run up the last few years, experiencing significant multiple expansion combined with high and steady growth in sales and earnings. The stock has appreciated from sub 20 USD per share to above 120 USD per share in the last 5 years, and is up 1000% in the last 10 years.

As always, we start by taking a look at what they do, then we look at some numbers, and finally try and make some conclusions and put it against the current valuation. First we are going to look at the most recent full year report (2020) and then take the most recent figures from the lates quarter (Q2 2021).

Lets start with what Copart is all about. Copart is a “leading provider of online auctions and vehicle re-marketing services with operations in the United States (“U.S.”), Canada, the United Kingdom (“U.K.”), Brazil, the Republic of Ireland, Germany, Finland, the United Arab Emirates (“U.A.E.”), Oman, Bahrain, and Spain”. About 90% of revenues come from the US operations, and the rest are lumped together as “International”.

“Vehicle sellers consist primarily of insurance companies, but also include banks, finance companies, charities, fleet operators, dealers and from individuals. We sell the vehicles principally to licensed vehicle dismantlers, rebuilders, repair licensees, used vehicle dealers, exporters, and in some jurisdictions, to the general public. The majority of the vehicles sold on behalf of insurance companies are either damaged vehicles deemed a total loss; not economically repairable by the insurance companies; or are recovered stolen vehicles for which an insurance settlement with the vehicle owner has already been made.“

No customer accounted for more than 10% of Coparts revenue during 2018- 2020, and about 80% of the vehicles processed came from an insurance company seller. Copart notes that they see both other vehicle auction and sales companies, as well as vehicle dismantlers as competitors. Service revenue makes up the vast majority of Coparts revenues at about 90%, and the rest of the revenue comes from Copart buying and re-marketing vehicles on their own behalf.

Founder and chairman Willis Johnson owns just shy of 8% of the company, and CEO Jayson Adair owns close to 4% of the company. Other large shareholders are Vanguard and BlackRock.

I think the business is very interesting for a few reasons. Copart seems to benefit from scale and network effects, meaning that the more buyers and sellers use Coparts services, the better the product becomes. It is also interesting that the majority of the volume is done from insurers to dismantlers and rebuilders. Regarding their competitors, its natural that they compete with other vehicle auction and sales companies, however, they also say that they compete with the dismantlers that purchase their services. I’m not at all sure about the level of competition between Copart and vehicle dismantlers, but it’s usually negative when a business competes with its customers. This could also be just a line added in the 10K just to make sure Copart discloses its competitive environment accurately, even though it might be completely insignificant in practice. The actual competitors, and the nature of this competition, is something that should warrant some more digging, but I’m going to move on with the write up for now.

As to the financial performance, it has been nothing short of impressive. Since 2016, sales has increased by 80%, and net income and net earnings per share increased by more than 250%. This high growth has also been accompanied by very high margins. Operating margin has been above 30%, and net profit margin above 20% during 2016-2020. For the full year 2020 operating margin was 37% and net profit margin was 31%, which is very high.

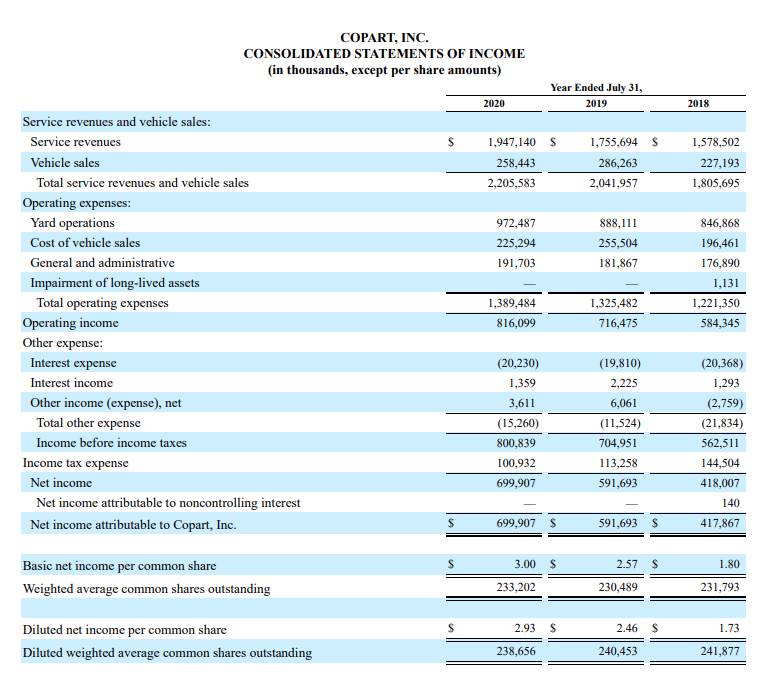

Looking at the income statement for the full year 2020 I see confirmation of what the above summary indicates.

The, by far, largest cost is operating costs related to their large number of yards. We see very high operating margins, and net income margins, as well as good growth. Furthermore, the diluted shares outstanding has been decreasing, which means per share numbers increase even more. Furthermore, the line items all seem reasonable, and I don’t see anything that sticks out or seem to need more explanation.

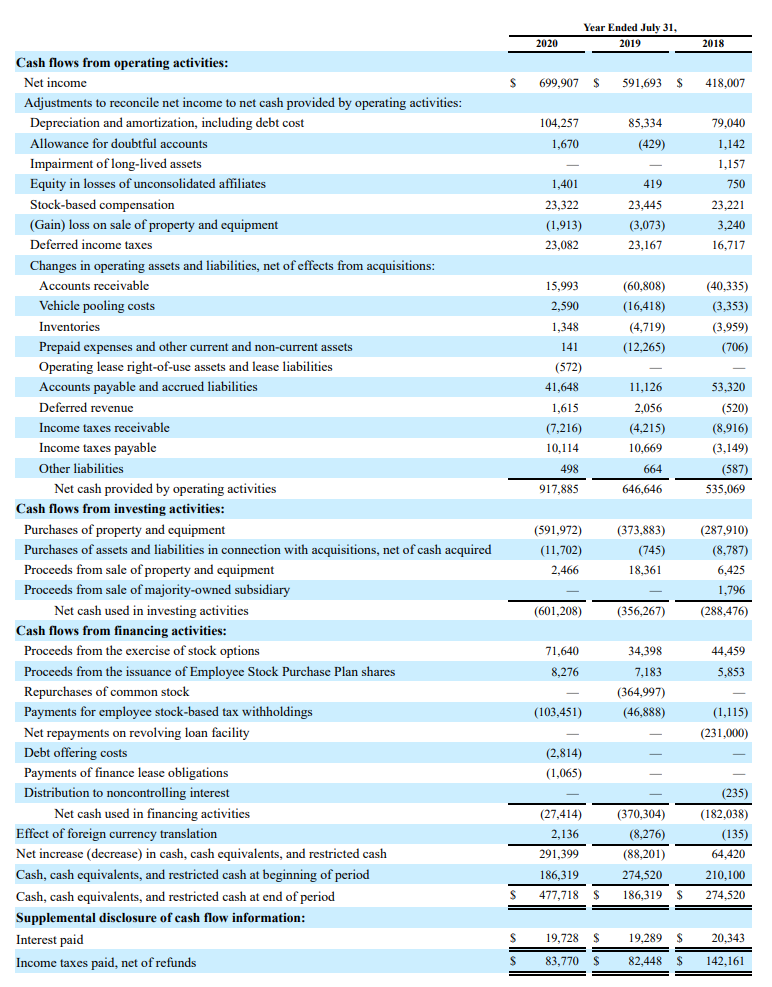

Looking at the cash flows, the same high quality is obvious. Operating cash flow is higher than earnings in each of the years we are looking at and has been growing at a very high pace. The major adjustments are depreciation, working capital, deferred tax, and stock based compensation. All of which are common and nothing really jumps out at me as egregious or out of place.

Speaking of investments, about two thirds of the operating cash is re-invested in the business through purchases of fixed assets. It is not incredibly clear how much is maintenance and how much is growth, but I’m guessing the vast majority of the investments are for growing the business. This is also in line with their communicated growth strategy to “Acquire and Develop New Vehicle Storage Facilities in Key Markets Including Foreign Markets”.

Stock based compensation has not increased notably in the last three years, and to me it does not look like it is unjustifiable. Depreciation has been increasing, but not faster than revenue, operating income, or earnings, and increasing depreciation is expected when the growth in large parts comes from additional investments in more yards etc.

Finally, all of the financing cash flows are related to stock options and stock based compensation. Since they are so cash generative there is no need for external capital.

To summarise the full year figures, I’d say incredible combination of high growth, very high margins and good cash flows, and great opportunities for re-investment at high expected returns. With that said, lets take a brief look at the most recent quarterly filing.

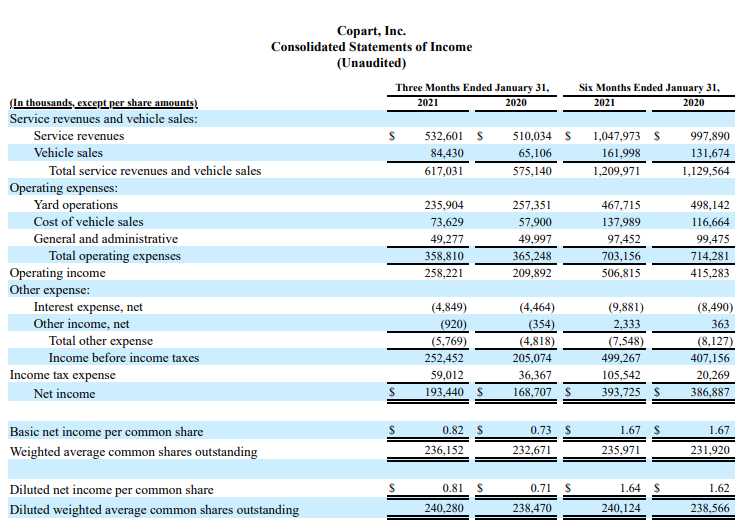

No surprises in the income statement, very high operating margins, and net profit margins. A bit more than 5% growth in sales, but an impressive 20% growth in operating income for the last six months compared to the same period last year.

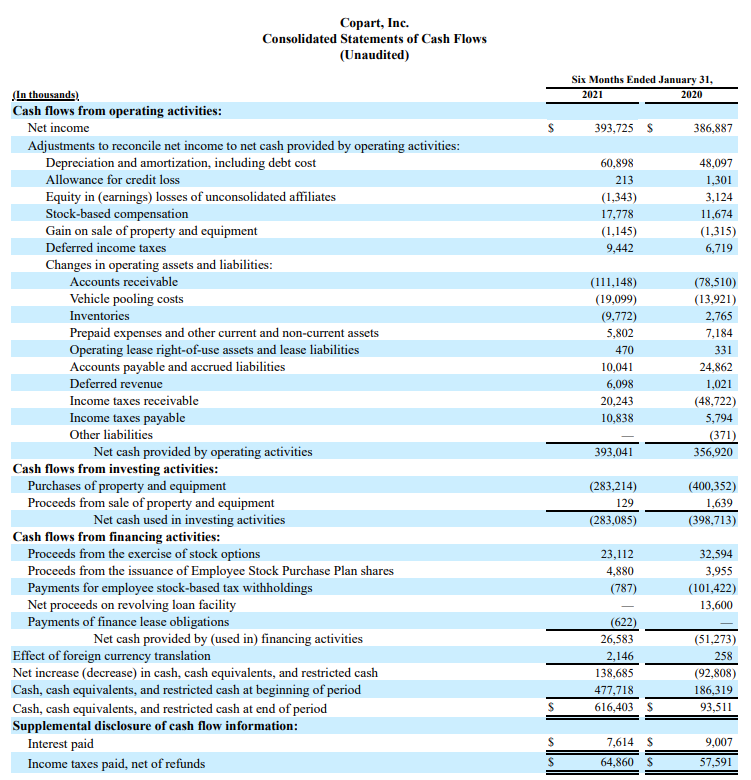

In the cash flow statement we see the same thing. Cash from operations are very close to actual earnings, and at high levels compared to revenues. Also like we saw in the annual report, most of the cash is re-invested in the business through purchases of property and equipment. For the six month period, the dollar amount invested is lower than the same period last year, but it is still in line with the stated growth strategy. As with the full year 2020, we also see some cash flows related to employee stock options and stock based compensation. There is of course no equity raise, and there seems to have been nothing significant done related to the debt.

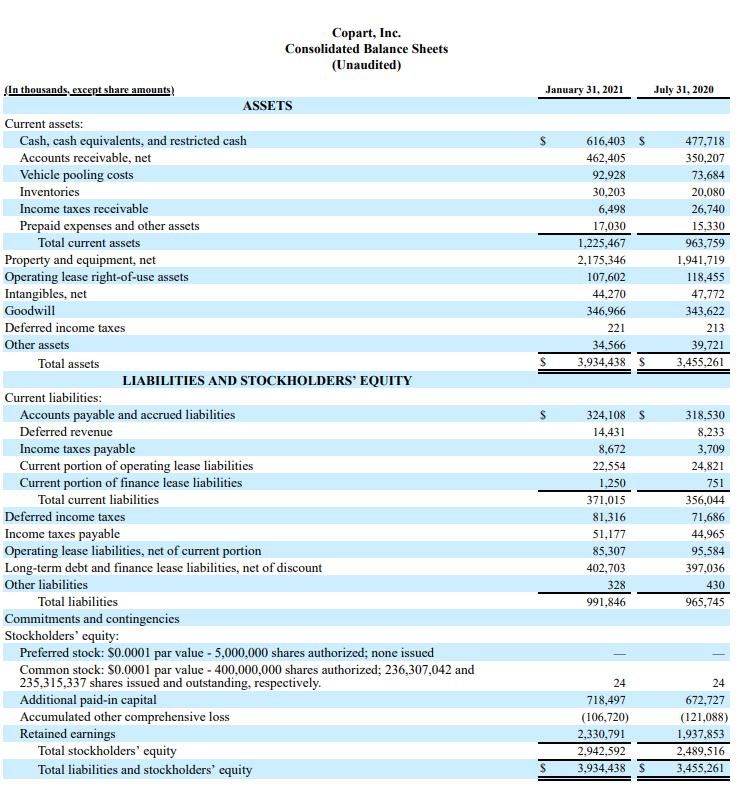

Finally, a look at the most recent balance sheet.

Close to 3.9 billion of assets funded by 2.9 billion of equity and 1 billion of debt. The majority (2.1 b) of the assets are made up of property and equipment, in other words, mostly physical yards. Copart also has about 1 b of cash and receivables, and the rest is intangibles, goodwill, and “other assets”. Moving down we see that almost all of the current liabilities are accounts payables, and the rest of the debt is mostly long term debt, and deferred taxes. This looks like a very solid balance sheet, since all debt is covered by cash and receivables.

To briefly summarise so far, very impressive financials. A business that seems to have good economics, and scales well. Copart seem to have good opportunities for re-investments in growth with continued high margins and cash generation. Now lets take a look at valuation. At the time of writing, the market capitalisation is about 31 billion USD, and adjusting for debt and cash the enterprise value is about the same. This gives us the following multiples for the trailing twelve month period: 13x sales, 34x operating income, 44x earnings, and about 34x operating cash flow. Not cheap, and it shouldn’t be, given the high margins, steady growth, and good opportunities for re-investment.

Looking at the historical growth of per share earnings, the compounded growth rate is about 25% for the last 7 years. The current P/E is quite close to 2x the historical compounded growth rate. If we use the 10 year growth rate, the CAGR is closer to 20%, which leaves us at over 2x P/EG. That is actually not too expensive, given the assumption that the past growth rates can be maintained. If the growth rate, for whatever reason, slows down to say 10%, then we are looking at over 4x P/EG. In other words, to me it looks like Copart is currently priced as if the past high growth rate, with sustained high margins, will continue for several years.

I don’t think there is a lot of margin of safety at the current valuation, but I can definitely see why the market is pricing Copart at a premium. The business seems to have some competitive advantages, and I think Copart can continue to grow and maintain its profitability for several years. However, I don’t think the quality of the company has escaped anyone, as the valuation shows. I’ll put Copart on my watchlist, and will for certain revisit the stock should it reach a lower valuation. It could maybe be a good investment at these valuation levels, but I’m sure it’s a GREAT investment at a lower valuation.

I hope you liked this edition of ValueTeddy’s Write-ups! If you want to suggest stocks for me to look at, you can tweet @ValueTeddy, and do check out valueteddy.com. Please note that this is in no way a recommendation or financial advice and I’m not your financial adviser.