Brief Portfolio Write-up

For this weeks edition I want to do something different. If you have been following me for a while, you know that I regularly update my current portfolio here. However, I don’t really comment on my holdings too much, and I don’t think I’ve ever shared a write-up on any of the stocks I own. Therefore, today I’m doing a brief rundown of the stocks that I currently own as of 2021-05-11.

I think It goes without saying that I own all these stocks, and this is not financial advice, nor is it a solicitation to buy or sell anything.

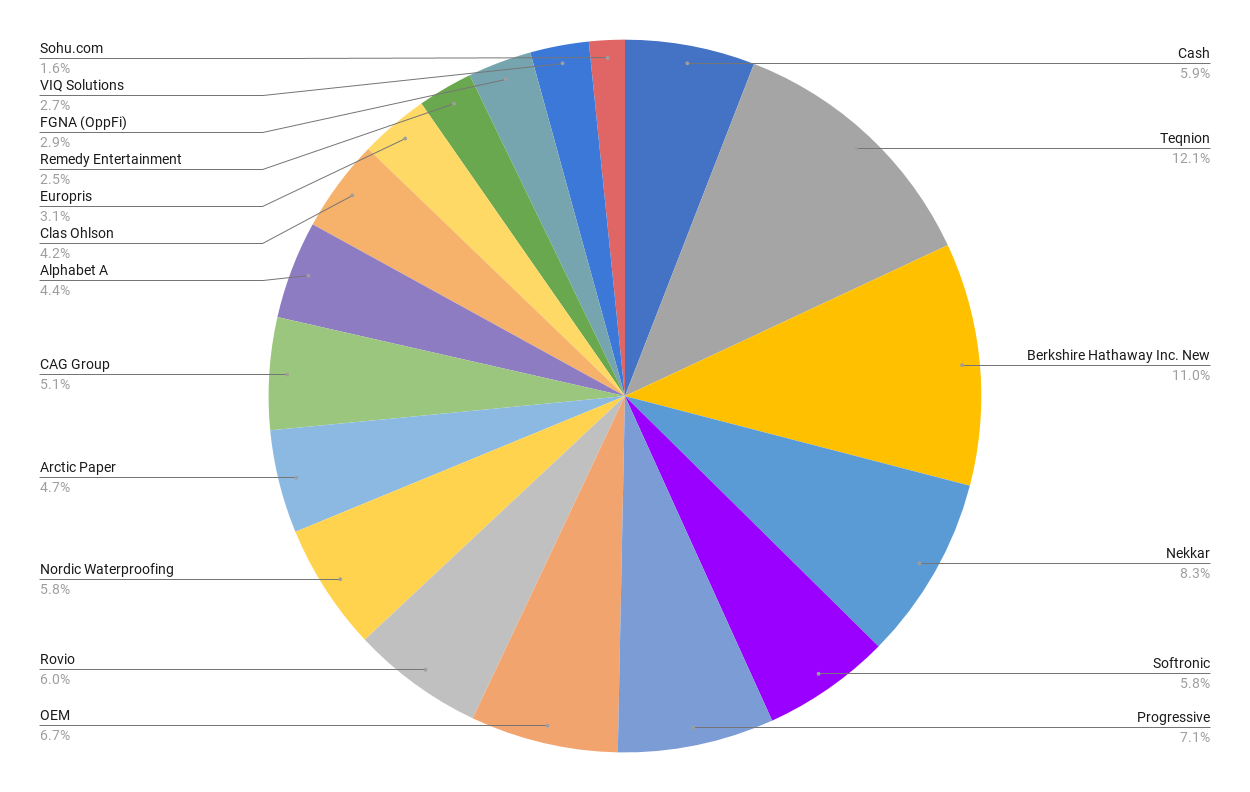

First, lets talk a little bit about the portfolio as a whole. Since the start of the pandemic, I have been trying to maintain a concentrated portfolio. Before 2020 I would probably hold somewhere between 20 and 25 positions, simply because I liked looking for companies, and then didn’t really read up on them enough to be confident to take real size. This current portfolio is one I am actually quite happy with, it has 17 positions, weighed roughly in terms of conviction. The largest position is a little bit too large, but I don’t mind that the weight shifts around a bit. Now lets get into each position a bit.

Cash + Global Index fund: Currently, this is only in cash, and it a historically relatively small cash position. In times where I have had a larger cash position, I have put parts of it into a global low cost index fund. For many years I held too much cash, and the index position is a new thing I have been experimenting with and it has paid off in the miasma of market stimulation. At its largest, I think the index position was close to 20% of the total portfolio, which gave much better return than just cash.

Teqnion is a relatively small industrial group, led by what I deem an energetic CEO with a long term mindset. They aim to grow through acquisitions and organically, which they have done quite successfully. The organic growth has been quite severely hit by the pandemic, but they have managed to complete some acquisitions. I like the historical profitability and margins, and I think they can manage to build a solid and respectable firm. This position has been my most successful position ever in terms cash return. It has thus had quite a good run looking back a year, but I think they can at least somewhat outperform the market.

Berkshire Hathaway probably doesn’t need an introduction. My expectations are market returns but with lower risk associated. Berkshire might be one of the best companies ever built, obviously biased as a huge fan of Buffett and Munger.

Nekkar is a great example of the value of Twitter. This is a case that I looked at because some profiles that I like and respect said that they liked the case, and so do I. The way I see this case is that they have a very profitable base within ship lifts, which is valued at what I deem quite an acceptable level. On top of this Nekkar is investing into two growth projects. One is an automated cage solution for farming of fish, and the other is some project directed towards wind power. This is not yet elaborated on, and both these are very early stage ventures. However, I do see good potential in both of these, and I think Nekkar is one of the better cases in my portfolio.

Softronic is an IT consultant and IT solutions provider mainly focusing on cities and municipalities in Sweden. This used to be part of a basked of IT consultants that I have since sold, but kept Softronic. This is somewhat of a cookie-cutter case that I would generally like. They have some growth, good and expanding margins and returns, and when I bought this stock it was not that expensive. It has since had quite a run.

Progressive strikes me as quite cheap, but I admit that insurance is difficult. The reason I decided to look at Progressive is mainly that some of the wisest men in insurance (Buffett, and Jain) have praised Progressive as the leader in car insurance, and that Geico is constantly trying to keep up with them. This is the only position I feel is larger than it should be given my own conviction. However, Progressive have impressive growth, great margins, and is quite cheap. The problem with insurance is a topic for another time, but eventual problems don’t show up until later, and the eventual losses are quite hard to predict.

OEM is a distributor and seller of industrial components to a diverse set of industries on a global scale. Unfortunately OEM is no longer as cheap as when I bought my position, but it appears to be a high quality company. Steady growth, good and increasing margins, and great returns on capital.

Rovio is most well known as the creators of Angry Birds, a franchise is quite old. In the most recent years they have tried to expand their IP-portfolio, and they are right now stepping up customer acquisition spending in order to enter another growth phase. My case is that I think this spend will pay off, and that Rovio thus is quite cheap. This is a position i believe have one of the better risk/reward in the portfolio currently.

Nordic Waterproofing are active within, you guessed it, water proofing materials. They have had good operational development, showing both organic and acquired growth, and a massive run up during 2020. I consider Nordic Waterproofing to have good margins, good growth, and good return on capital.

Arctic Paper is first of a bunch of outliers in the portfolio. It is not as high quality as I consider the other businesses, but it is trading insanely cheap. As the name reveal, Arctic Paper make and sell paper and pulp. They hold a majority stake in another listed pulp manufacturer named Rottneros, and own paper mills in Poland. This causes the reporting to be a little bit more difficult to read than what one might be used to, but still trustworthy in my opinion. It is of course highly cyclical, but even adjusting for cyclicality I think the company is quite cheap. This is however a more difficult case, and is one where I am not extremely confident in being right.

CAG is another IT consultant and is thus quite similar to Softronic. CAG however trades at quite a discount to Softronic, but with what I think is similar quality. CAG has had some recent issues with organic growth, but have completed some acquisitions, and I think the organic growth will be in level with the overall market for IT consultants. Since they are a bit cheaper than Softronic, I see this as one of the better risk/rewards in my portfolio currently.

Alphabet probably don’t need an introduction. I think this is one of the best stocks in the FAAMG family, a great business, and when I bought Alphabet it even traded at a relatively low multiple.

Clas Ohlson is a retailer offering items such as hardware, tools, home items, electronics, and other odds and ends. They have had a bit of trouble even before the pandemic, for example engaging in failed geographical expansion, and a lacking e-commerce. The poor expansions have since been reversed, and they are currently showing good growth in online sales. I think the market is treating Clas Ohlson too harshly, especially when looking at a free cash flow basis.

Europris is a Norwegian low cost store chain, with a history of good growth and high profitability, and they have navigated the Norwegian lock downs very well. I think this can continue post pandemic, and thus it looks like a very cheap business. Both Europris and Clas Ohlson are similar cases, as they are somewhat a bet against the story of the death of retail. Thus they are almost to be considered as part of the same case, and should I change my mind on one of them, the other is likely to go at the same time.

Remedy Entertainment is one of my best cases in terms of percentage performance, but in very small size. Remedy is a Finnish game studio, probably most known for Control and Max Payne. I found this case after seeing what a great game Control is, and they have a pipeline of a few AAA-titles. One in co-operation with Epic Games. Remedy is trading at astronomical multiples, but I like the case on other merits and I’m going to hold onto my shares until the pipe-line has been somewhat emptied. I would not assume high returns from current levels simply because of the very very high valuation.

Now we are getting into coat-tail territory, all these cases are basically me riding someone coat-tails, and have not yet done enough work to consider myself confident in these names.

FGNA is a SPAC that is expected to merge with OppFi, a financial services company offering what I think look like payday loans to what they call an under-banked segment of the population. It is a very complicated deal that I honestly do not fully understand, however the market does not seem to like it at all since it is trading close to 10 dollars. This is one of my lowest conviction cases, and it might be booted out on a whim.

VIQ Solutions is a case written up by AltaFox capital. For more information I recommend looking up AltaFox’s Q1 2021 quarterly letter, where Connor describes this case. The research I have done seem to confirm what Connor is betting on, and I also like the opportunity. VIQ is not a company that normally fit within the frame of what I usually look for, and could be considered something other than a “great business at a bargain price”. This is also a case I’m not fully confident in, but I like it a bit more than FGNA, on a confidence level.

Sohu is a case where I’m riding the coat-tails of a fantastic Swedish twitter profile named @89Olle. I recommend reading his write up on the company here and I wholeheartedly recommend following him.

That’s it, the entire portfolio as is. I want to reiterate, none of this is financial advice nor recommendations. As is clear, I own all of these stocks and is of course biased. I may sell any of these positions, and I don’t intend to be held responsible for your investments. Do your own research.

This posts main reason is to let me put my thoughts down into writing, so I can look back after closing the position, or whenever I am thinking “why the hell did I buy this”. I do highly recommend writing down your own cases, just so that you know what you were thinking as you purchased the position. Doing so combats several dangerous cognitive biases, and helps us as investors to learn from our mistakes and successes. It lets you answer the important question: “Did you get it right because of luck or skill?”.

I hope you liked it, and remember that none of this is financial advice and I’m not your financial adviser. Next week I expect to do a normal Snap Judgement, and if you want to suggest stocks for me to look at, you can tweet @ValueTeddy. Also, please do check out my website valueteddy.com.